Everyone has gone digital. If you haven’t yet, you’re behind, but not a lost cause. Fortunately, all you really need to join the ranks of some of the most successful online shopping sites is a domain name, website, and payment processing option. The big question that we get asked a lot is “what is the best eCommerce payment gateway for my website?”. Here, we will break down each and focus on factors when deciding which payment gateway option is best for your website.

The domain name (i.e. yourbusiness.com) is a lot like buying a virtual lot to build your online store upon. Once you own that land, you’ll want to focus on building your storefront. So you build a website (or hire professional website designers) to create what your online store will look like. This typically results in a full website with multiple pages or a landing page with everything they need on one scrolling webpage.

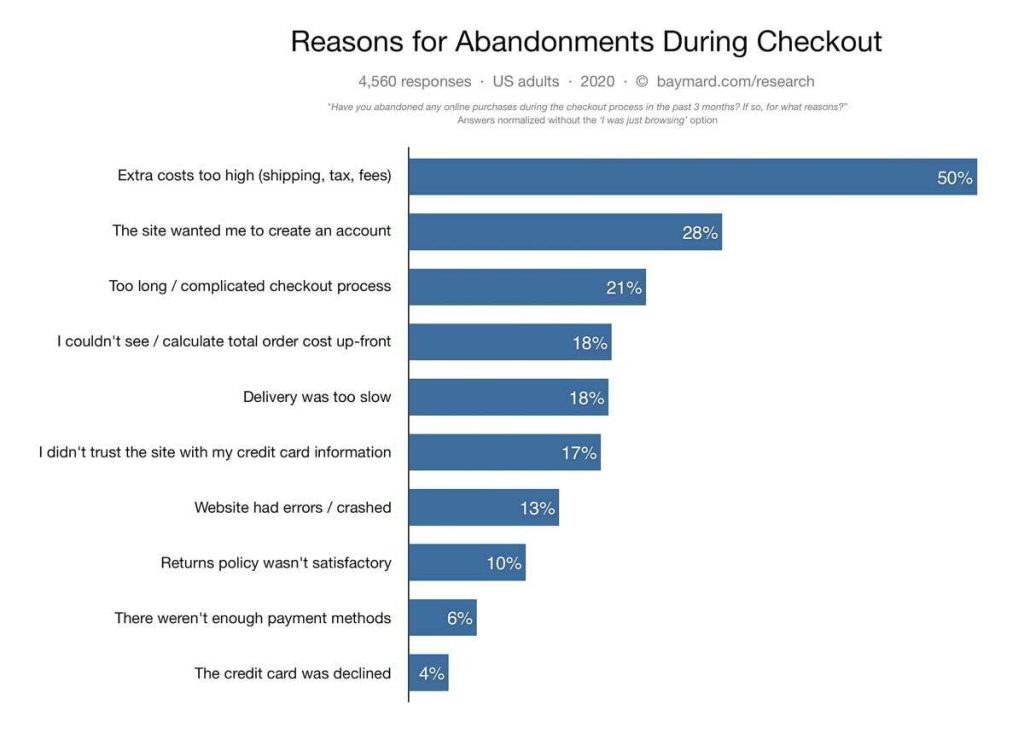

Then, like any successful, revenue-generating store, the cashier takes payment. Online, this looks like a payment processing area where those visiting your site can easily find what they want and pay for it quickly, without hiccups or long lines. While the online shopper’s experience is obviously first finding your site, then browsing happily through what you have to offer, one of the most often overlooked and critical pieces to the success of your sales is how easily your customers can check out with what’s in their cart. If you don’t think that’s a big issue, consider that 21% of shoppers have abandoned carts because the checkout process was too long or complicated.1

It’s like if you were at a clothing store, found everything you needed (even a couple of extra impulse items), and then, could not find your way to the checkout stand. Or even worse, you’re asked to fill out a form, then sent to another stand to pay for your goods, to then be sent back to the first stand to get your receipt. It’s just not a good experience. You probably wouldn’t go back and, depending on how much you actually wanted your item(s), you may just leave your cart there and walk out the door.

What is the difference between a ‘payment gateway’ and a ‘payment processor’?

First, I want to clear up one thing that gets brought up a lot. There is a difference between a ‘payment gateway’ and a ‘payment processor’. You may have a POS system or bank that offers online payment processing, which is great. However, not all of those companies have their own dedicated payment gateway that integrates with WooCommerce. We encourage you to use your current processors if possible and rates are better for you, just know that you will need a gateway to go with it at an additional cost for setup. Using your already-in-place payment processor limits the need for an extra financial account to keep track of. In this article, we are just going to cover the payment gateways that are also payment processors.

Does Every E-commerce Site Need a Payment Gateway?

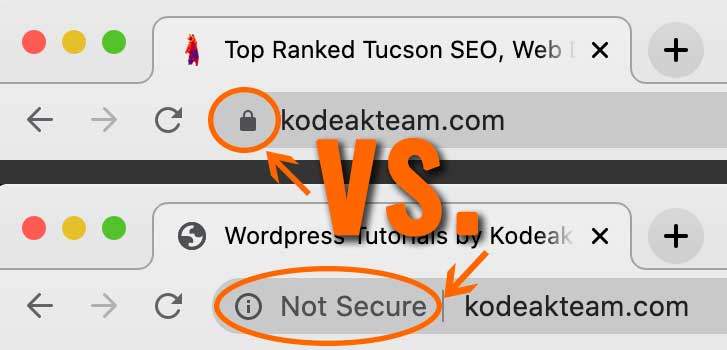

From products and services to gift cards and donations, every website where the transfer of funds is taking place needs to have a payment gateway. These payment gateways are not just the ability to process payments but also, more importantly, a fraud prevention method practiced by payment processors to safely transfer funds between your customers and you. Trust us, they want this. 85% of web users state they wouldn’t buy through a website where they weren’t certain their data was being transferred securely. 2

What is an SSL and do I need one?

SSL stands for “Secure Sockets Layer” and is a secure protocol developed for sending information securely over the Internet. Many websites use SSL for secure areas of their sites, such as user account pages, web forms, and online checkout. When your eCommerce website has an HTTPS, versus HTTP, your customer’s information and purchases will be encrypted from their browser to your server. This makes it far more difficult for external parties to steal or extract your customer’s personal or financial information. This usually looks as simple as https in your web browser address and a secure lock icon. In fact, most browsers show a “not secure” message in red in the address field when there isn’t an SSL on the site. That alone makes all the difference to those browsing and buying online with confidence. If you want to process payments on-site, there is no way around it, you will need an SSL.

Honestly, every website should have an SSL certificate anyway. As Google and other search engines look at this kind of security as an indicator that you will keep their users’ information safe, it has become a big ranking factor in the SERPs (search engine results pages).

Which Payment Gateway Should I Choose?

There are many different payment gateway options to choose from. Many of which are secure and fairly easy to navigate. Let’s take a deeper dive into some of the most popular payment processing options and compare everything from compatibility to their cost-effectiveness with your website. Note that in this article, we will be specifically comparing these payment gateways used on the WordPress CMS platform.

PayPal Standard

PayPal standard is one of the most popular payment gateways for several reasons. First, it isn’t uncommon at all for a customer to already have a PayPal account and be familiar with paying through PayPal. Also, because PayPal has its own security measures, you don’t have to be concerned with processes that take place through their site and off of yours.

However, that IS the issue. Customers have to leave your site to finalize their checkout process. The ease of having a Pay with PayPal button may seem like a great deal with its small transaction fees and ease of use, however, in the long run, it may be costing you far more in potential sales. Most customers prefer to pay in one place, even if it is at a subconscious level. The longer the transaction process and login obstacles, the less likely they are to complete the buying process. Customers want what they want quickly and effortlessly. Plus, you lose the ability to control the entire checkout process and experience off-site payments.

If you are already using PayPal Standard on your eCommerce website and wonder if you are losing customers to the process, check your Analytics and see if you have any drop-off between the checkout page and the receipt page.

How to read your Google Website Analytics

PayPal Pro

PayPal Payments Pro is the ideal solution to the dilemma of off-site purchasing. Like PayPal Standard, you still have the trusted and highly-recognized PayPal option, but you can add the ease of on-site checkout experiences. What’s even better is you control the entire checkout process and have the ability to customize the checkout page with options like discount codes, last-chance add-on purchases, and more. This gives you the ability to better analyze and course-correct any points in the checkout process that are causing users to drop off. PayPal Pro still boasts no setup fees but does require a $30 monthly fee on top of the typical transaction fees. Still, this $1/day difference could be worth far more in maximized conversions.

Stripe

Stripe is another payment gateway option that is gaining popularity. It is right on par with PayPal Pro as it allows you to take on-site payments and it doesn’t involve any setup fees either. Beyond that, it doesn’t charge monthly fees either, making it a contender with PayPal Pro. Stripe also has an effective anti-fraud team on hand that manages any questionable transactions.

So then, what more is there to consider? Well, because Stripe was made by developers for developers, you will either have to navigate and manage several plug-ins to integrate Stripe or hire someone to do so for you. This could end up costing more in time and budget than had you opted for the ease of PayPal Pro. Not to mention, Stripe, while growing to more and more countries and capable of accepting over 100 different currencies, is still behind PayPal in numbers and in brand favorability. Customers know and trust PayPal, making their decision to continue their purchase through that gateway a no-brainer.

Amazon Payments

Heard of Amazon? Of course, you have. So has the rest of the world. This means that their likelihood to trust and use Amazon for online payments is very high. That said, Amazon Payments is a gateway option that gives customers peace of mind while simplifying the checkout process from their perspective. You are still able to process payments on-site for a more streamlined checkout experience plus you benefit from Amazon’s fraud protection service.

As with other gateways, costs are comparable to PayPal and Stripe with no setup fees and the usual 2.9% charge + $.30 per transaction fee.

Another easy choice, right? Well, despite how well-known Amazon is as a brand front, it may take a bit more knowledge to add it to your website on the back end. The user will also need to have an existing Amazon account in order to complete a purchase with this payment option. Integrating Amazon Payments may also require some plugins with your WordPress site – something you aren’t familiar with or have to pay to outsource elsewhere. It’s simply something to consider when deciding if it’s more cost-effective to go for a less complicated gateway system.

Authorize.net

Think you’ve heard all your options? Think again! When it comes to supporting online businesses, you have plenty of software companies looking to help you, while also helping them grow as trusted payment gateway entities. Authorize.net is another highly-regarded, popular payment gateway. Authorize.net has comparable fees to other contenders, but they do require an additional $25 monthly.

Authorize.net works with WooCommerce integration, an official extension that costs you $79 more, but in turn, it provides a high-quality on-site payment gateway. Using this option allows you to accept all major credit cards directly from your website, as well as, PayPal payment options. This is great considering it is a combination of two well-known and trusted payment gateways.

They haven’t skimped on security either, offering their Advanced Fraud Detection Suite. This support team is on hand for any sort of payment issue you want to get resolved quickly. From a connection to QuickBooks that talks to the accounting side of your business, plus the capability to support recurring payments, you may find that Authorize.net is a cost that is worth its convenience.

How to Decide on a Payment Gateway for Your Website

With so many options available, and all of them providing many benefits to both your company website and your customers’ shopping experience, it can seem difficult to find what’s best for you. The truth of the matter is that we can look at your overall goals for eCommerce and conversion, match that with your marketing budget, and implement the easiest, most cost-effective option(s) based on everything from countries and currency conversion to monthly fees and maintenance costs. We may even find that combining two or more payment options heightens conversion simply because customers prefer options. Let them choose between, say, PayPal Standard and/or Amazon checkout – both of which are free to set up and integrate. Plus they add a well-respected trust symbol to your checkout in the form of two big-name brands.

Payment gateways and plug-ins are easy for us, so really it’s a matter of figuring out what your end goal is and setting up your eCommerce website to support such. We are here to help you create a user-friendly web design that offers the path of least resistance for revenue.

1. Baymard – Cart abandonment rate

2. Global Sign – 85% of online shoppers don’t buy on unsecured websites